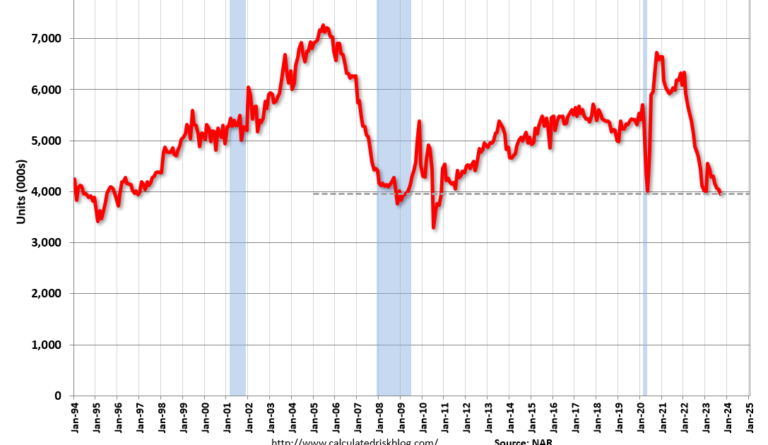

The Treasury bond market crash has created turmoil across financial markets, affecting stocks, foreign currencies, cryptocurrencies, commodities, and the housing market. As traders drop long-duration US bonds, yields are skyrocketing, leading to a decline in the S&P 500 and Nasdaq. The rise in yields has triggered a surge in the US dollar and weakened foreign currencies. Cryptocurrencies and non-interest-bearing assets like gold have taken a hit. Industrial metals, such as copper, aluminum, and zinc, have also declined. Additionally, mortgage rates have risen, impacting home-buying activity. Meanwhile, while oil is less affected by bond market swings, the strengthening dollar is pressurizing crude prices.