Wall Street’s AI Obsession: Hype or Reality?

Introduction

When Wall Street catches a whiff of a new innovation that could drive earnings growth, it tends to get a little overexcited. Sell-side analysts at investment banks rush to put out bullish research reports on related companies; economists and strategists start discussing the potential impacts of the new tech for growth, inflation, and productivity; and money managers begin to ponder the implications of it all for their portfolios. It’s a flurry of activity and interest that can quickly turn into a self-reinforcing hype cycle featuring highly optimistic forecasts.

The Rise of Artificial Intelligence

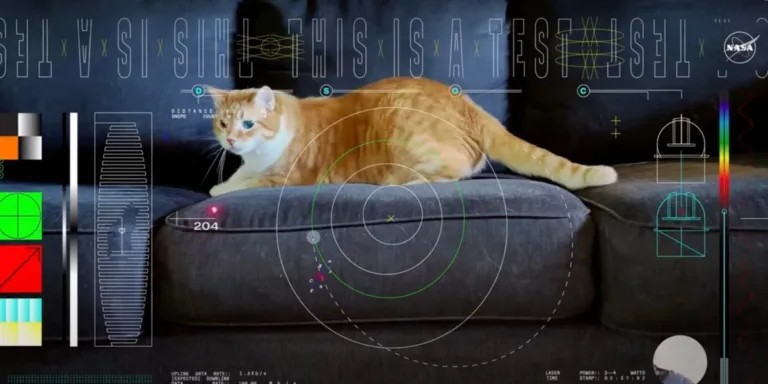

The rise of artificial intelligence is the latest example of how the Street can become attached to a new technological advancement. The widely successful release of OpenAI’s chatbot ChatGPT in November sparked a wave of enthusiasm about generative AI’s potential to reshape the world, usher in an age of abundance, or even cure the incurable—all while boosting worker productivity and reducing corporate costs. Ever since, analysts have been watching for signs of AI’s impact on corporate earnings, particularly when it comes to big tech, and firms that show promise in drawing in new AI-related revenues (like Microsoft or Nvidia) have seen their stocks soar. Meanwhile, there’s been a steady stream of research reports and studies pouring out of Wall Street that push (and only occasionally downplay) the AI hype.

The Split on AI

Fortune analyzed hundreds of pages of AI reports from investment banks, hedge funds, and investment research firms and found some striking similarities. In short, the Street is incredibly bullish on the long-term prospects of AI, with analysts arguing it will boost worker productivity and GDP on a scale similar to the birth of the internet — eventually. But that’s the key word: eventually. Wall Street’s research reports and studies reveal a split between experts who believe that the near-term AI hype is overdone, and those who argue it’s justified given the rapid adoption of the technology and potential for long-term success.

Wall Street’s AI Reports

Bank of America Research: “AI Evolution: Reality Justifies the Hype” and “AI Evolution: Stock & ETF Beneficiaries”

Key Quote: “It’s not just tech companies that will benefit from AI’s newest wave. Our view is that GenAI’s transformational potential will likely be similar to the transformation driven by past disruptive technologies like the telephone, automobile, personal computer, and internet, which have historically reached mainstream adoption after 15-30 years.”

Key Statistic: Corporate AI implementation could cut S&P 500 companies’ costs by ~$65 billion over the next 5 years and AI’s economic impact could reach $15.7 trillion by 2030, according to BofA’s estimates.

Carlyle: “”Brave New World: AI and its Downstream Implications”

Key Quote: “Generative AI has been analogized to the advent of electricity, and this comparison may be apt…We must also be mindful of the ‘hallucination problem’ with LLMs [Large Language Models]…human verification of their outputs will still be required in many cases, and their use in mission critical applications like aeronautics or defense could lay very far in the future.”

Key Statistic: Between 60% and 70% of employee workloads could eventually be automated by generative AI applications, according to a McKinsey study.

UBS: “”Will Generative AI deliver a generational transformation?”

Key Quote: “While not a ‘digital god’, Generative AI’s capabilities have advanced at a remarkable pace. The costs of developing and training models today typically run to many millions of dollars but open-source models are gaining ground and adoption of the technology appears set to be swift.”

Key Statistic: Some 40% of all working hours could be impacted by the rise of generative AI, according to data from Accenture.

Citi: “Unleashing AI: The AI Arms Race”

Key Quote: “As a concept, artificial intelligence (AI) is not new, and Generative AI represents the latest inflection point in the evolution of AI. However, what is distinctive about Generative AI is the tremendous potential it holds to transform work across industries and boost overall productivity.”

Key Statistic: By 2025, 30% of outbound marketing messages from large organizations will be synthetically generated, up from roughly 2% last year, according to estimates from the industry research firm Gartner.

Goldman Sachs: “Why AI is not a bubble”

Key Quote: “Current valuations in the technology sector are not as stretched as in previous bubble periods and the ‘early winners’ that have enjoyed the strongest returns have unusually strong balance sheets and returns on investment.”

Key Statistic: Productivity growth could rise by just under 1.5% annually over the next decade if AI undergoes widespread adoption, boosting global GDP by 7%, according to a Goldman Sachs study.

Morgan Stanley: “AI: The Long and Short of It” and “AI & The Annual Beauty Contest”

Key Quote: “For employment, I continue to be skeptical of the gloomy prognostications that a myriad of workers will lose their jobs to new technology. Economies evolve, and the advent of the lightbulb has not left a lingering horde of unemployed candlemakers.”

Key Statistic: Monthly downloads of AI models on Hugging Face, the most popular repository for open-source AI models, have soared this year. Between January 2021 and August 2023, the top 10 models on Hugging Face have been downloaded 3.5 billion times.

Deutsche Bank: “AI Update: Six key themes you missed while you were at the beach”

Key Quote: “Job losses have been one of the most immediate concerns about generative AI, despite historical evidence showing that over the long term technological revolutions have typically led to new, higher quality jobs, greater productivity, and economic growth. However, emerging evidence over the summer suggested some fears may be unfounded, with AI likely to augment rather than replace white-collar jobs.”

Key Statistic: The potential effects of AI-based automation on employment are much more drastic in high-income countries. Some 5.5% of total employment in high-income countries is exposed to automation effects, compared to just 0.4% in low-income countries, an August International Labour Organization (ILO) study shows.

Capital Economics: “AI, Economies and Markets – How artificial intelligence will transform the global economy” and “How we see AI playing out in stock markets”

Key Quote: “AI will have a similar impact on equities to the one that the Internet had during the second half of the 1990s when the ‘dotcom bubble’ was inflating…Of course, bubbles eventually burst. But it could be years before that occurred in this case. Regardless, we don’t think that would sound the death knell for AI – any more than the bursting of the dotcom bubble, which was at least five years in the making, sounded one for the Internet.”

Key Statistic: Productivity gains during the internet revolution hit 1.5% per year in the U.S., and that could be a “reasonable guide to what is achievable” during the AI revolution as well, according to Capital Economics.