Mortgage Applications Decreased in Latest MBA Weekly Survey

The latest Weekly Mortgage Applications Survey by the Mortgage Bankers Association (MBA) reveals that mortgage applications decreased by 0.8 percent from the previous week.

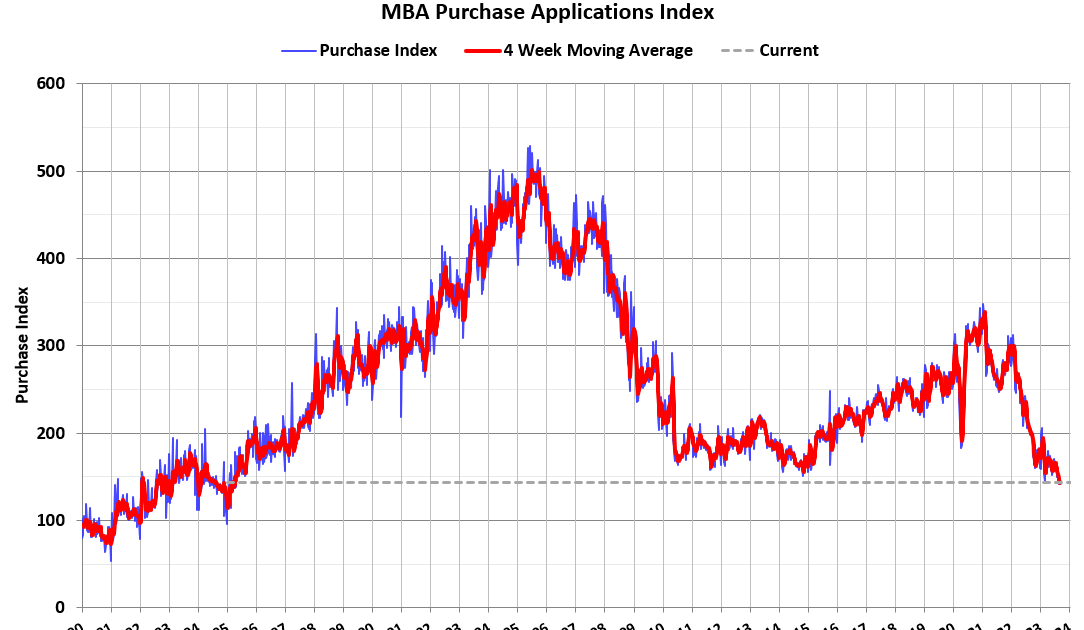

This decline marks the seventh decrease in eight weeks and brings the applications to the lowest level since 1996. Refinance applications dropped by 5 percent, reaching the weakest reading since January 2023.

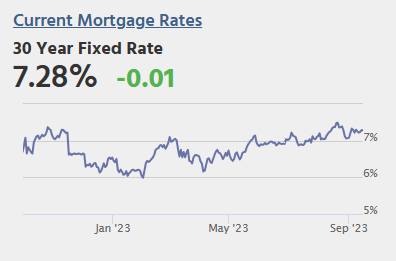

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained that the decline in applications can be attributed to the increase in the 30-year fixed mortgage rate, which rose to 7.27 percent last week. This rate is 40 basis points higher than it was in late July. Kan also mentioned that despite the rise in rates, purchase applications saw a 1 percent increase due to a 2 percent gain in conventional loans.

The average interest rate for 30-year fixed-rate mortgages increased to 7.27 percent from 7.21 percent.

Key Takeaways:

- Mortgage applications decreased by 0.8 percent, reaching the lowest level since 1996.

- Refinance applications dropped by 5 percent, marking the weakest reading since January 2023.

- Despite the increase in rates, purchase applications increased by 1 percent due to a gain in conventional loans.

- The average interest rate for 30-year fixed-rate mortgages increased to 7.27 percent.

Source: MBA: Mortgage Applications Decreased in Weekly Survey